Rachel Reeves made history on 30th October 2024 by becoming the first female Chancellor to deliver a budget with Labour’s Autumn Budget 2024.

The budget is complex and detailed. So, in true Procure Smart style, we’ve looked out for busy business owners and highlighted the key relevant points in this accessible, quick-form guide.

This blog is presented politically impartially and will utilise most of its analysis from the Office for Budget Responsibility’s (OBR) Autumn Budget 2024 Economic and Fiscal Outlook document.

The Autumn Budget 2024 in context

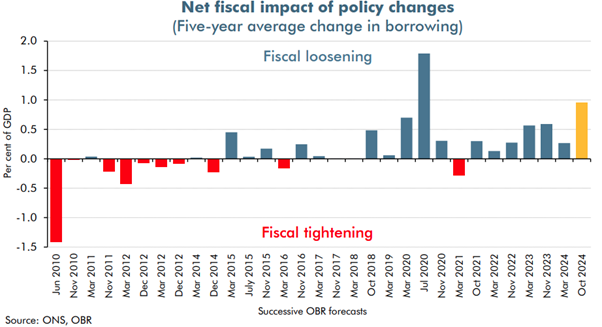

Overall, Labour’s first budget since 2010 is expensive. It features the second highest net growth in borrowing of the 31 budget announcements since June 2010.

It has also increased the amount the government had planned to spend over the next five years as a share of GDP since March 2024.

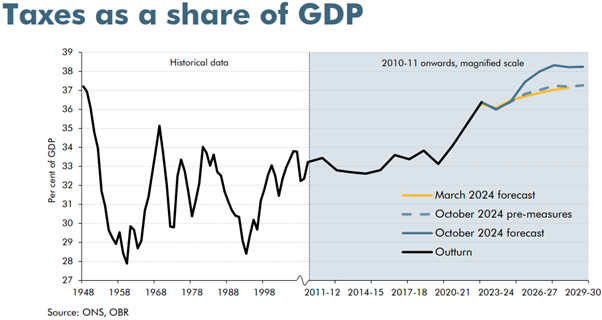

It will take taxes as a share of GDP to the highest point since 1948, breaching a record 38% by 2026. This is alongside a reduction in borrowing within five years as a share of GDP (despite a 1% increase in 2025), essentially planning to tax more in order to borrow less.

Changes to tax for businesses

- Companies will now pay National Insurance (NI) at 15% from April 2025, an increase of 1.2%

- This applies to salaries from £5,000 upwards, instead of £9,100

- Employment Allowance will increase from £5,000 to £10,500. This is relevant to businesses, charities and CICs whose total NI liabilities were less than £100,000 the previous tax year. These businesses can claim up to £10,500 back. You can check if your business is eligible for NI Employment Allowance here

- Private Equity Managers will need to pay more tax on successful deals, up from a maximum of 28% to a maximum of 32%. This begins in April 2025

- The corporation tax main rate (for over £250,000 of profits) will remain at 25% until the next election

The National Insurance increase has been met with some criticism from business bodies. Despite a pinch of protection for the smallest of businesses via the Employment Allowance increase, British Chambers of Commerce has dubbed the announcement as a “tough budget for business”. Its Director General, Shevaun Haviland, did however praise some of the longer-term thinking in the choices Reeves has made and stressed the importance of continued investment in national infrastructure.#

Transport

- Bus fairs are on the up, with the £2 cap increased to £3, apart from Greater Manchester and London, who have been spared by their devolved authorities

- HS2 will be completed to Euston Station in London via an underground tunnel, as well as a Transpennine rail upgrade

- The 5p cut to fuel duty on petrol and diesel has been extended for a further 12 months and Vehicle Excise Duty (road tax) will be applied to Electric Vehicles (EVs) for the first time in 2025. Vehicles costing more than £40,000 will also attract an “Expensive Car Supplement” of £425 per year

- Electric Light Commercial Vehicles (LCVs) will be taxed the same way as petrol and diesel LCVs from April.

- Employer National Insurance contributions we’ve previously covered will affect company car schemes as Class 1A workplace benefits, increasing Class 1A bills by 8.7% and further incentivising EV company cars, which are charged at only 2%

Overall, businesses with car schemes, fleets or commercial vehicle usage will see costs rise across the board in the long term, from fuel to taxes. Many EV schemes and owners will see new taxes introduced where they have previously been negligible or exempt, but they are still considerably lower than petrol, diesel or even hybrid alternatives under the long-term rules.

Most businesses will have been exploring the benefits of electric fleets and schemes for some time, but it is clear from the Autumn Budget 2024 that the government wants to hit the accelerator on the UK’s transition to full-electric and despite introducing new taxes on EVs, it is arguably widening the gap to taxation on expensive, petrol and diesel vehicles.

Innovation, investment and relief

- Retail and hospitality sectors, still reeling from the effects of the pandemic and crippling inflation, have been handed a boost with an extension of rates relief. However, this has been reduced from 75% to 40%. Capped at £110,000, this relief will last until the end of 2026

- The Energy Profits Levy (EPL) will increase by three percentage points to 38% as soon as November 2024 and has been extended to the end of March 2030

- The 80% decarbonisation investment allowance will continue, but will reduce from 80% to 66% in November 2024

- Boiler upgrade schemes have received continued support with a £3.4 billion investment in heat decarbonisation and household energy efficiency, boosting confidence in renewables installation sectors

- R&D tax relief schemes have been maintained, meaning tax relief for R&D varies between 15% and 27%

Critics have suggested that the benefits of the reduced business rates relief for struggling sectors will barely be noticeable due to accompanying changes to minimum wages (covered later) and national insurance (covered previously).

Meanwhile, extensions to R&D and net zero technology innovation schemes, particularly in the North Sea, have been welcomed by the British Chambers of Commerce and PwC, although Vicky Parker, Power and Utilities Leader (UK) at PwC suggested that specific funding announcements to drive the UK’s transition to net zero were lacking.

Wages and employees

- The minimum wage for over 21s will increase from £11.44 per hour to £12.21 per hour from April 2025

- The rate for 18 to 20-year-olds will increase from £8.60 to £10 as part of a plan to create a single adult minimum wage rate

Wage rises are something most would support and champion, but it will feel like a blow to smaller businesses and those in struggling sectors, who will need to grapple with wage rises and increased NI contributions together, along with rising energy costs and cost of goods inflation, which the OBR has suggested will increase to just under 3% during 2025.

Private Schools

- Tax breaks for private schools will come to an end from the start of 2025, resulting in a 15 percentage point increase in VAT payable on boarding and tuition fees

- Private schools classified as charities will lose their charitable business rates relief, previously set at 80%

One of the most hotly contested announcements in the budget will see private education become more expensive. The receipts from the tax collected will be invested in the UK’s education system to “improve opportunities for the nine out of 10 children who attend state schools” according to the government’s education hub website.

Private schools are not taking the news lightly. The Independent Schools Council (ISC), which represents 1,400 private schools, is planning legal action against the decision on the basis that it breaches the European Convention on Human Rights and will affect children with special educational needs.

Whilst private schools essentially operate as businesses and the logic of the decision is evident, arguable detrimental impacts on the education of children will make this dispute a difficult one to untangle.

Summary

Overall Labour’s Autumn Budget 2024 is heavy on tax increases and short term pain with the promise of long term gain. Progress against this promise will be closely monitored by businesses in particular, who have yielded the burden of many of the increases.

The government has certainly made their stance clear on a number of areas with their fiscal strategy. Particularly that businesses failing to transition or embrace low carbon technologies and the net zero transition will feel pain as a result. Increased taxation on non-electric vehicles and increased incentives for low carbon innovation show a clear direction of travel and should provide some guidance on business strategies for the next five years.

Likewise, sectors such as energy and transport are firmly under the microscope and should expect further disruption in coming years.

The OBR suggest that only during the “pain” years will this budget’s impact be positive, forecasting an increase in GDP from 1.2% to 2% within a year. However has clearly suggested that more radical thinking will be needed thereafter to change the UK’s growth fortunes, claiming: “budget policies leave the level of output largely unchanged by the final year of our forecast.”