A guide to non-commodity costs on your energy bill

Updated on 30/09/2025

Business Energy Bills

Business bills are more segmented than domestic equivalents. With the increased complexity and the necessity for businesses to exert more control over their consumption, the non-commodity elements of a business energy bill contain more elements, which the person responsible for the contract’s agreement should consider.

What are non-commodity costs?

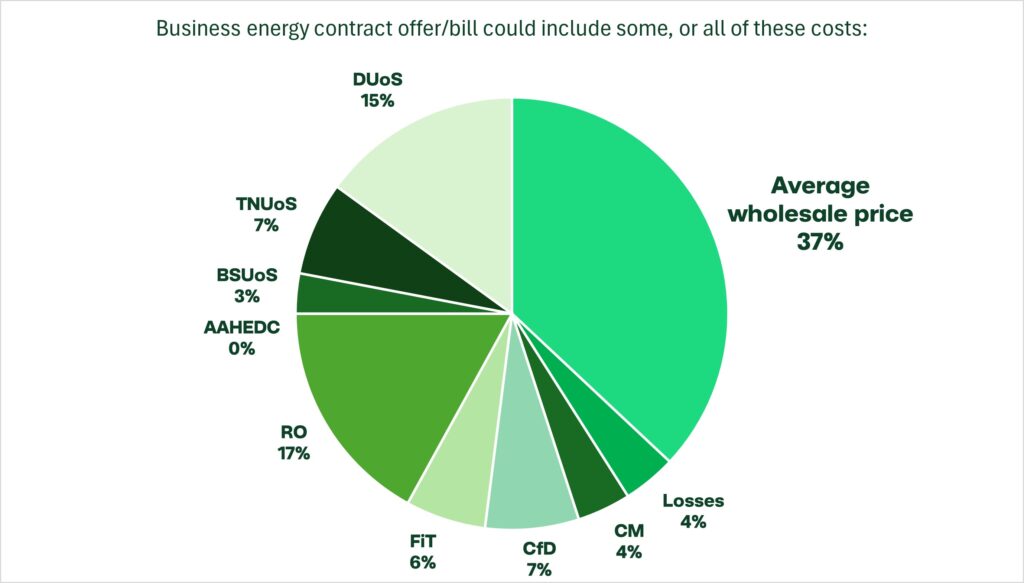

Non-commodity costs, also known as non-energy costs, are charges on an energy bill that cover the costs of delivering energy to consumers. They can make up around 60% of the total invoiced cost of electricity and 40% of gas for businesses, with some estimates suggesting they could account for as much as 80% of energy prices in the next decade.

The problem is that the non-commodity cost element of your bills increases frequently and these costs are sometimes not itemised nor apparent.

Essentially, the amount you pay for your business energy includes different expenses:

1 – COMMODITY: Wholesale cost of the power used.

2 – NON-COMMODITY:

2a – Cost of transmission and distribution across the network

2b – Government levies and taxes which are ‘passed through’ by the supplier to the end user.

Average commodity wholesale cost

- Commodity prices are applicable to specific periods throughout the year, with rates often higher during the winter.

Non-commodity elements of business bills:

Distribution Use of System (DUoS)

- This charge pays for the maintenance of your local energy infrastructure.

Transmission Network Use of System (TNUoS)

- This part of your bill is paid to the Transmission Network Operators for maintenance of the national transmission infrastructure.

Balancing Service Use of System (BSUoS)

- They are a financial fee levied by the National Grid to recoup the costs of operating the system on a daily basis. These daily charges are paid by suppliers and generators based on their energy taken from or supplied to the National Grid in each half hour Settlement Period.

AAHEDC (Assistance for Areas with High Electricity Distribution)

- Assistance for areas with high electricity distribution costs (AAHEDC) is a scheme that was introduced in the Energy Act 2004 to help lower the cost of electricity distribution in certain areas. The North of Scotland is the only area that currently receives AAHEDC assistance.

Renewables Obligation (RO)

- The Renewables Obligation (RO) places an obligation on licensed electricity suppliers in the UK to provide a specified number of ROCs per MWh of electricity supplied. Each year the Government set out what the RO obligation will be.

Feed-in-Tariff (FiT)

- The charges are a result of the FiT scheme, which is a subsidy that encourages the use of small-scale renewable energy in the UK. The scheme was introduced in 2010 and is funded by payments from suppliers, which are then passed on to customers.

Contracts for Difference (CfD)

- This is an Electricity Market Reform (EMR) mechanism to help the UK meet its carbon reduction targets and ensure security of electricity supply. Costs are met by a levy applied to energy suppliers, which are then passed on to consumers

Capacity Market (CM)

- A scheme to secure additional winter capacity from both generators and Demand Side Response providers. This is needed to help secure electricity supplies for the future. The subsidy payment for these generators is paid for by electricity consumers on their consumption in the winter period.

Line Losses

- This is the quantity of electricity that is lost during transmission and distribution of electricity across the electric grid. The supplier must purchase sufficient energy to cover the projected estimated consumption (including line loss amount), this loss gets divided and cost passed on to customers.

Nuclear RAB (regulated asset base) Levy

- This supports the development of critical infrastructure to support the UK’s increase in nuclear capacity, including the ongoing Sizewell C development. The levy is based on consumption and set quarterly by the Low Carbon Contracts Company (LCCC).