Energy regulator Ofgem has published the annual Non Domestic UK Market Research Report, highlighting the value of TPIs amidst UK business’ experiences of the marketplace in 2024.

Carried out by IFF Research, the report examines areas the market can be improved and monitors the progress of key players such as suppliers and Third Party Intermediaries (TPIs), as well as how businesses experienced key processes such as switching supplier and raising a complaint.

Overall, the research shows that experiences and perceptions of the business energy sector are improving, however there is still more progress needed.

Here, we examine some of the themes and conclusions drawn from the 1,000 UK businesses surveyed.

Headline figures from the report

- 27% of respondents said they were struggling to pay their energy bills. This dropped from 39% in 2023.

- 33% had switched supplier in the previous year, an increase from 26% in 2023.

- Respondents indicating that cost was a barrier to renewable projects dropped from 32% to 21% this year.

- 23% of respondents had made an energy supplier complaint in the last 12 months.

Analysis of themes

Overall, the report painted an improving picture of the non domestic energy market, with many areas still needing work.

Communication between businesses and suppliers was a subject which permeated many different sections of the report. This is demonstrated through statistics such as the following:

- Only 1% of respondents classified as “struggling with bills” had been contacted by their supplier.

- 20% of businesses surveyed whose contracts had ended in the last 12 months said they ended up on an out-of-contract (OOC) rate.

- “Other participants said they would like some additional features in their bills including the ability to link bills with digital tools to better analyse and optimise their energy usage.”

Whilst 62% of respondents indicated they were satisfied with their supplier’s overall service, smaller and micro businesses have reported dissatisfaction disproportionately (18% dissatisfaction versus 3% with large businesses).

This makes some sense, considering the far greater numbers of small and micro businesses versus large businesses. It is much easier for suppliers to provide strong service to the smaller number of high-consuming customers, who also benefit from lower unit rates by way of economies of scale.

The answer, potentially, as outlined in the qualitative statement in our bullet point above, could be greater investment in the technology provided to customers. Whilst all suppliers have a portal or log-on system of some sort for their customers, they don’t always offer a route to raise queries in a way that problems can be solved and certainly are not adopted unilaterally by customers.

With the advent of AI, there are certainly elements of supplier-to-business service which could be enhanced through technology to reduce waiting times and solve queries faster.

Many of the issues across the energy sector are due to the unavailability and inaccuracy of information relating to meters and usage. Ofgem is aware of this and has prioritised the rollout of smart meters as a solution. Despite this, more certainly needs to be done over the longer term in this area as the UK’s energy infrastructure evolves to lower carbon and increase security.

Switching Suppliers

REPORT: 78% of respondents said that they found the switching process easy when moving from one supplier to another.

This is a key figure within this research. Ofgem have gone to great lengths to improve the switching process in the UK, including imposing “faster switching” meter release deadlines in 2022.

It shows improvement. 2023’s research said 60% found the switching process easy by comparison. Those finding it difficult also dropped from 2023 to 2024 (18% down to 10%).

These figures are now showing the results of improved sector processes, but could go further with improved communication and freedom of information within the administration of the energy sector.

The value of TPIs in the non domestic energy sector

Adam Brown, Brand and Digital Director at Procure Smart, said: “As a TPI, we were particularly interested in how businesses perceived our impacts on the non domestic sector. Both in terms of the statistics and the qualitative responses, we were very pleased with what the report shows.

“We are vocal about doing things the right way at Procure Smart and it is pleasing to see that so many TPIs are earning their customers’ trust and advocacy.

“The numbers in this research showed that TPI customers found switching easier, were less likely to have an energy related complaint and saw value in the expertise we provide. As with the sector as a whole, there are areas to improve. But the numbers paint a favourable picture of working with a TPI versus dealing directly with a supplier.”

REPORT: “85% of businesses who used a TPI reported the switching process to be easy, versus 78% without.”

This shows TPIs’ ability to explain the switching process and take care of any of the fiddly administration that takes place once a business signs their contract. Especially if your business is changing tenancy, moving premises, changing meters or installing renewables, TPIs can smooth out the whole process.

REPORT: “Some participants reported that there were inconsistencies in the ways that suppliers presented tariffs and other contract information, and this made it difficult to assess which contracts were more favourable on price than others. Others felt that contracts were too complex to understand fully, which prevented them from making an informed decision.”

Consistency of information is certainly a wider issue across the market. The amount of energy a business consumes has at least three different descriptive terms across the sector, for example. Having an expert TPI with decades of experience comparing contracts can demystify this area for a confused business.

53% of respondents described themselves as having “low energy literacy” I this research. Those are the people who could benefit most from this service.

Procure Smart actually has the ability for businesses to run a tech-driven comparison of their costs themselves with no agent involvement. Check out Switch Savvi here.

Clarity of commission

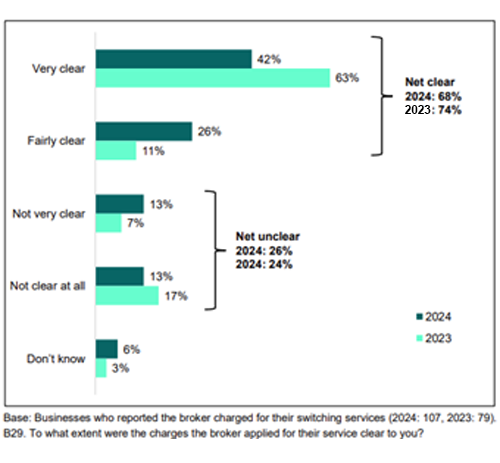

The diagram above shows that TPIs have not made progress on making their commission clear to customers.

For micro and small businesses up to certain consumptions and spends, TPIs are required by regulation to disclose their earnings on each contract they place. It is expected that this will be rolled out to all business sizes, which should improve clarity on this subject.

Some suppliers require a totally separate document to be signed to detail this, whilst others show it as an itemised cost prior to signature. Switch Savvi also displays commission alongside each deal it presents to users.

REPORT: “The qualitative research found that businesses typically considered these charges to be reasonable, given the quality of the service received and cost savings achieved (compared to going through an energy supplier directly). Some described the charges as expensive but saw them as a necessary part of the process. A few participants felt that [TPI] charges could have been made clearer, although they ultimately felt that the charges were fair.”

Ultimately, the introduction of mandated disclosure has not negatively impacted TPIs operating properly in recent years. Encouragingly, customers who understood their TPI’s commission in this study felt that they were fair.

Adam Brown continued: “We hope that independent research pieces such as this one will encourage Ofgem to engage further with TPIs via the Energy Consultants Association (ECA). This paper confirms that businesses are benefiting from using TPIs through excellent service, sharing of expertise and administrative support.

“Businesses classed as small and micro were more likely to report dissatisfaction with supplier service (18% versus 3% of large businesses) and yet were least likely to work with a TPI (36% versus 70% large businesses). This follows a trend in previous surveys and we think small businesses can benefit from engaging with TPIs. We hope that statistic will improve for next year’s study.

“At Procure Smart, we’ll continue to develop tools and services to help UK businesses. We work with more than 1,300 customers and are using the data that affords us to drive improvements which make utility procurement easier, faster and more transparent.”